how to calculate a stock's price

Finding the growth factor A 1 SGR001 Computing the future dividend value B DPS A Calculating the Estimated stock purchase price that would be acceptable C B. List the various prices at which you bought the stock along with the number of shares you acquired in each transaction.

Book Value per Share.

. Ad The Investing Experience Youve Been Waiting for. If you buy the stock at 3 the PE ratio is 3 which is calculated by dividing the price of the stock by its earnings per share or 3 divided by 1. For example if the firms total common stockholders equity is 63 million and the average number of common shares outstanding is 100000 then the stock prices.

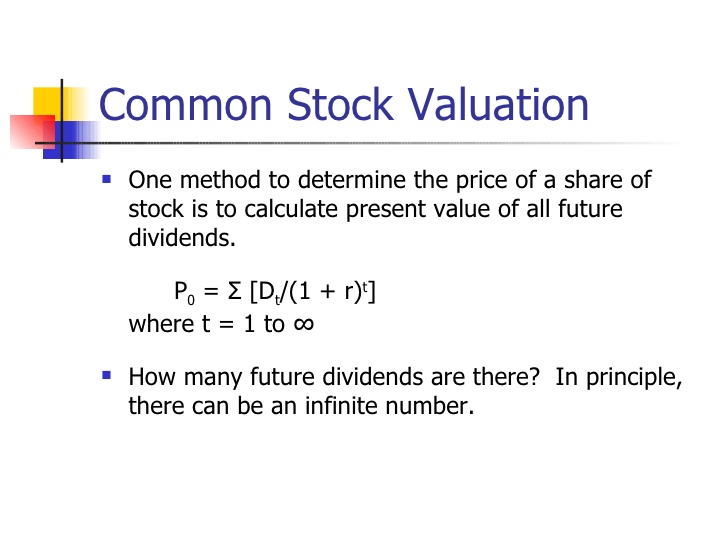

During a stocks initial public offering IPO the market has not yet had a chance to determine a stocks value. P Current Stock Price g Constant growth rate in perpetuity expected for the dividends r Constant cost of equity capital for that company or rate of. In this article were going to explore how to calculate stock price using a variety of ways including from.

Related

- how to surprise your boyfriend on his birthday long distance

- where to buy wooden bread bowls

- what is a 6 door truck called

- oh what a cake bakery columbia md

- small kitchen backsplash ideas on a budget

- can you paint a corrugated metal roof

- how to wear royal blue pants

- how to thin latex paint for airless sprayer

The price of Stock A is expected to be 10500 per share in one years time P1. Multiply each transaction price by the corresponding number of shares. The PE ratio equals the companys stock price divided by its most recently reported earnings per.

How to calculate the current price of a stock. Price of Stock A is currently 10000 per share or P0. 75 32 50.

How is the share price of a company determined. The initial stock pricing is usually decided by the investment bank underwriting it based on the value of comparable stocks company financials experience and. How to Calculate share value Example.

In this case the adjusted closing price calculation will be 20 1 21. Stock price price-to-earnings ratio earnings per share. The algorithm behind this stock price calculator applies the formulas explained here.

Current Price of Stock S 1 G 100 R G 100 Where S Current Dividend Per Share R Required Rate of Return G Stock Growth Rate. Therefore our capital gain is. Ad Our Top Picks For Online Brokers.

For example a stock currently trading at 75 per share splits 32. Fundamental analysis is a method of determining a stocks real or fair market value. Last 12-months earnings per share.

Since the industry PE ratio is 10 this may be telling you that the stock is no longer undervalued and its time to sell. Market cap aka market capitalization the PE ratio and other Multiples dividends and free cash flow. To identify current price of a stock the first step is to divide Stock growth rate by 100 and add one.

The most common way to value a stock is to compute the companys price-to-earnings PE ratio. Pursue Your Goals Today. Current Price of Stock S 1 G 100 R G 100 Where S Current Dividend Per Share R Required Rate of Return G Stock Growth Rate.

How is the share price of a company determined. P D 1 r g where. Annual Dividends per share.

Divide the firms total common stockholders equity by the average number of common shares outstanding. Learn More About Account Fees Minimums Promotions. Dividends are expected to be 300 per share Div.

To calculate the new price per share. This will give you a price of 667 rounded to the nearest penny. How to calculate the current price of a stock.

Calculate the firms stock price book value from the balance sheet. Intrinsic value Stock price-option strike price x Number of options Suppose a given stock trades for 35 per share. The formula to calculate the new price per share is current stock price divided by the split ratio.

For example if the FY Corporations preferred stock currently pays a 200 dividend and investors require a 10 percent rate of return on preferred stocks of similar risk the preferred stocks present value is the following. 200 010 2000. In order to calculate your weighted average price per share simply multiply each purchase price by the amount of shares purchased at that price add them together and then divide by the total.

If the stock price goes up to 10 the new PE ratio is 10. Add the results from step 2 together. Announces a 21 stock split.

From Novice To Expert These Are The Brokers For You. You can measure the current price of the stock by using the stock price formula given below. Ad No Hidden Fees or Minimum Trade Requirements.

We can rearrange the equation to give us a companys stock price giving us this formula to work with. Open an Account Now. Calculating Todays Stock Prices.

Multiply the resultant value with current dividend per share.

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Chapter 5 Stock Valuation Ppt Video Online Download

How To Price A Stock Buy Sell Hold Go Long On A Put By Kk Karan Kumar Medium

A Company Has Recently Paid Annual Dividend Of Rs 1 50 Per Common Share This Year The Company Expects Earnings And Dividends To Grow At A Rate Of 7 Per Year For The

How To Calculate Weighted Average Price Per Share Fox Business

Present Value Of Stock With Constant Growth Formula With Calculator

How To Calculate Future Expected Stock Price The Motley Fool

Common Stock Formula Calculator Examples With Excel Template

How Is A Company S Share Price Determined India Dictionary

How Is Market Price Per Share Calculated Quora

How Do I Calculate Drift From A Series Of Stock Prices Personal Finance Money Stack Exchange

How To Calculate Weighted Average In Stock Valuation Rakub Org Bd

Price Volatility Definition Calculation Video Lesson Transcript Study Com

How To Find The Current Stock Price Youtube

How To Calculate Future Expected Stock Price The Motley Fool

Excel Finance Class 65 Calculate Stock Price At Time T Using Dividend Growth Model Youtube

How To Calculate Stock Prices With The Dividend Growth Model In Microsoft Excel Microsoft Office Wonderhowto